No Annual Fee

We skip the annual charge to make owning an SCCU Visa® credit card more affordable.

Get the spending power you want with the convenience, security, and low-rate options you deserve. Scenic Community Credit Union offers no-nonsense Visa® credit cards with great low APRs, no annual fees, and no cash advance or balance transfer fees. Whether you're looking to save on interest, pay down debt faster, or build or repair your credit, we have a card that fits your needs.

Ready to get started? Apply today or review our credit card terms and conditions for more details.

No Annual Fee

We skip the annual charge to make owning an SCCU Visa® credit card more affordable.

ATM Cash Access

Enjoy immediate cash advance availability at ATMs for quick access to funds.

No Fees on Advances or Transfers

Consolidate debt or access additional funds without incurring extra fees. We charge no cash advance or balance transfer fees.

Secure & Convenient

Spend confidently. Your Visa® card is accepted nearly everywhere and comes with contactless technology, EMV chip protection, and Visa® Secure fraud protection.

Mobile & Online Access

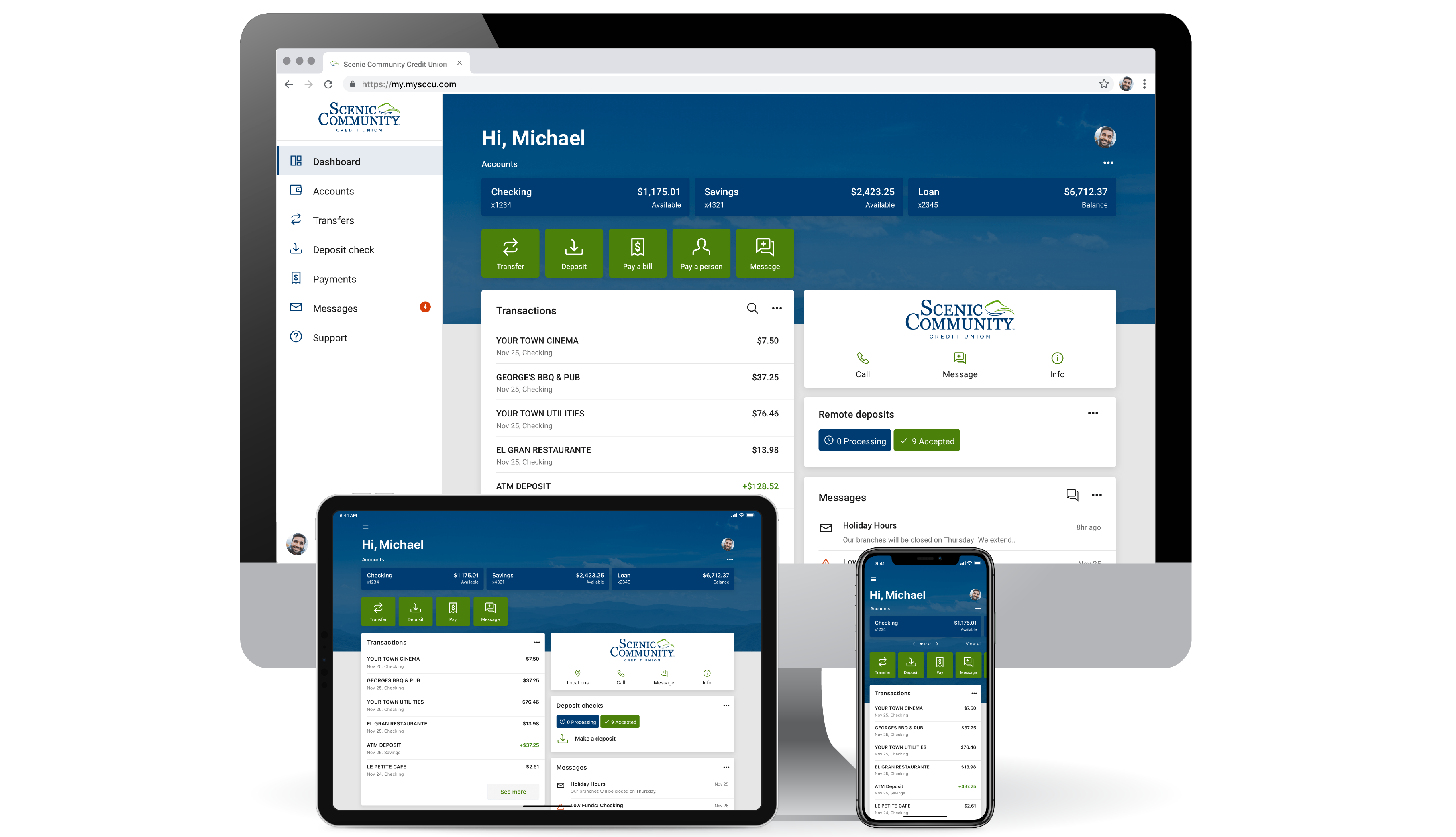

Check balances, view statements, make payments, and instantly turn your card on or off from your phone or computer.

Build or Repair Credit

Our Classic Credit Card offers the option of being secured by a deposit, helping you establish or rebuild credit with responsible use.

Looking for a simple, low-rate credit card designed to help you keep monthly payments manageable and pay down debt faster? The SCCU Visa® Gold Card combines value, security, and everyday convenience.

Enjoy all the benefits of a straightforward SCCU credit card while building or improving your credit history. Start with a modest line of credit with the option to secure your card with a deposit.

At SCCU, we care deeply about kids, and we know you do too. As a proud supporter of Credit Unions for Kids, we offer a credit card that gives back to the community with every purchase.

A percentage of the interest earned on your Children’s Hospital Visa® Credit Card is donated to the Children’s Hospital at Erlanger. Past proceeds helped fund the Kennedy Outpatient Center, and future contributions continue to support hospital improvements.

It’s a win-win for SCCU members and for children in our community.

Access your statements, make payments, and manage your card through SCCU’s online and mobile banking tools. Learn how these features work and where to get started below.

“We've been members of the credit union for years. The customer service, interest rates and accessibility are outstanding.”

— Sharon R., Hixson, TN

Members in good standing can apply online, over the phone, or in person at any branch.

Once your card is issued, contact SCCU with the account details of the balance you want to transfer. We’ll pay off the account and add the amount to your SCCU credit card.

Turn your card off immediately using our mobile app or digital banking portal. Report the loss as soon as possible to ensure you’re protected under Visa’s Zero Liability Policy. Contact 866-820-5971 to report lost or stolen. Turn your card off immediately through the credit card portal.

Yes. A portion of the interest earned on your card is donated to the Children’s Hospital at Erlanger to support facility upgrades and expansion projects.

You can pay electronically through our digital banking tools, over the phone (while paying with an SCCU account), or in person. Many members choose automatic payments from their checking or savings account for added convenience.

Our cards are designed for different needs—from low-interest options for reducing debt to secured options for building credit. Contact our knowledgeable team for guidance.

Skip the dealership stress and come to SCCU first. Enjoy competitive rates, a simple application process, and expert guidance to make financing your next vehicle fast, affordable, and hassle-free.

SCCU opens doors with low-cost fixed and adjustable-rate mortgage options. Apply online or visit your nearest branch to secure financing that fits your budget and helps you achieve homeownership with confidence.

Build a stronger financial future with SCCU’s reliable, flexible savings accounts. Enjoy easy access, competitive interest, and the security of a credit union you know and trust to grow your nest egg.