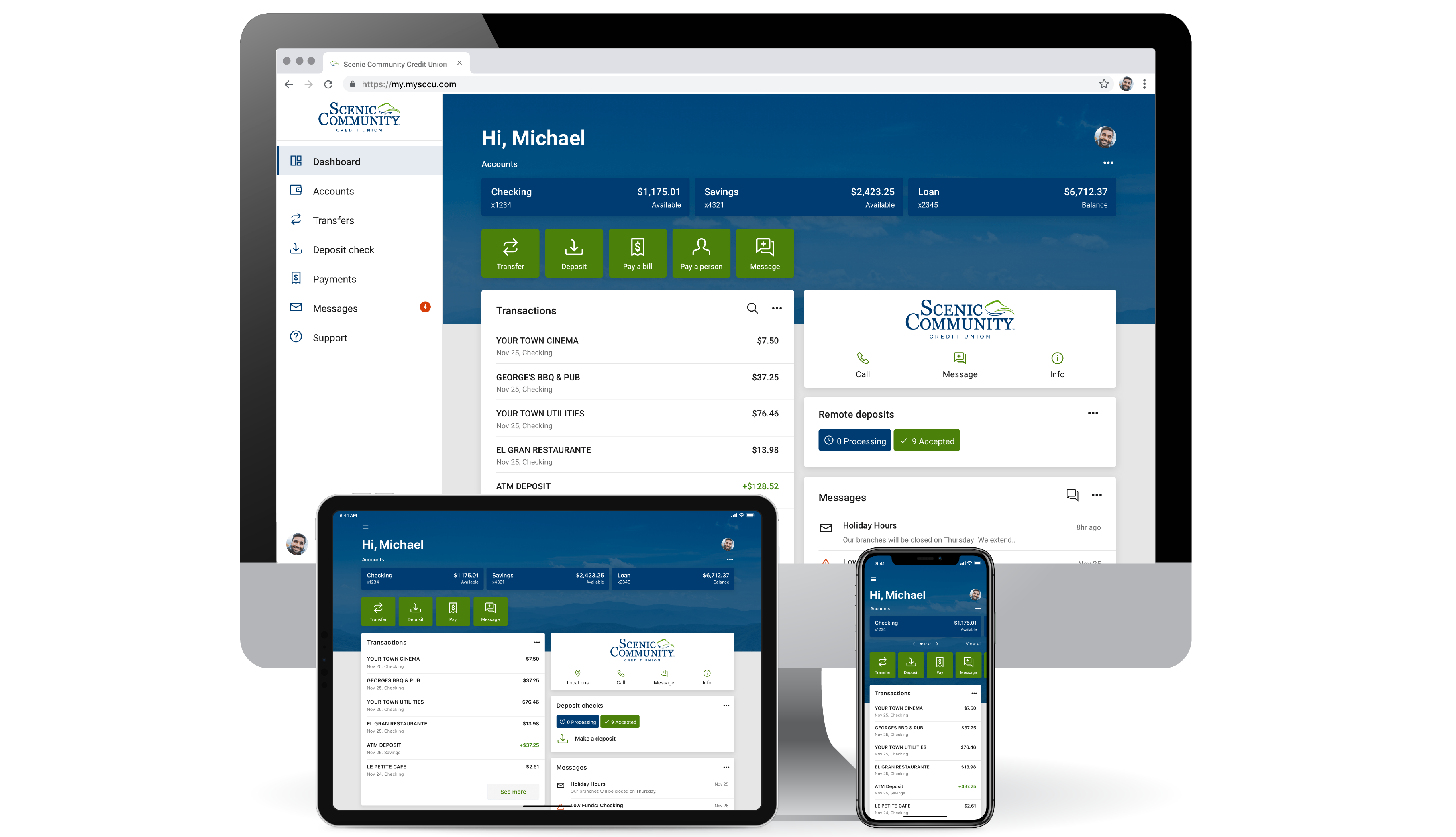

Access your accounts wherever you are with Online banking and mobile app. You have the convenience of having the same quality service on the go. A mini SCCU branch in the palm of your hands at all times with Scenic Community's free and easy-to-use Mobile Banking services.

Online Banking

- View all your accounts and recent transactions, and download or print transaction history.

- Make transfers between SCCU accounts, including setting up automatic transfers.

- Enroll in Bill Pay, add or delete payees, and schedule bill payments.

- Send money to an individual using Bill Pay's "Pay a Person" feature. (Hint: you can also use this feature to send money to your own non-SCCU accounts.)

- Apply to skip a loan payment for eligible SCCU loans. ($30 fee applies to approved Skip-a-Loan-Payments.)

- View your loan payoff amount.

- Manage your debit card.

- View and download eStatements.

- Set up alerts for when your balance goes over or under a certain amount, or when certain transactions are made.

- Request a Stop Payment. ($20 fee applies.)

- Request an address change.

- Message us with questions.

Mobile App

- Remote Deposit. You will still be able to deposit checks with your phone.

- Manage Bill Pay. With the new app, you will be able to enroll in Bill Pay, add a new payee, and schedule payments all within the app.

- View all your accounts and recent transactions.

- Make transfers between SCCU accounts, including setting up automatic transfers.

- Send money to an individual using Bill Pay's "Pay a Person" feature. (Hint: you can also use this feature to send money to your own non-SCCU accounts.)

- Apply to skip a loan payment for eligible SCCU loans. ($30 fee applies to approved Skip-a-Loan-Payments.)

- View your loan payoff amount.

- Manage your debit card.

- View and download eStatements.

- Set up alerts for when your balance goes over or under a certain amount, or when certain transactions are made.

- Request an address change.

- Message us with questions.

Need help?

If you need help with our Online Banking or mobile app, contact us here or call (423) 875-6955.